Financial Results of Year 2024

Increase in Turnover to €370.4 million and Sales Volumes of 120.7 thousand tons Strong Operating Profitability and Sustainable Low Net Debt Proposal of Annual Dividend of ~€0.23 per Share

THRACE PLASTICS Co. S.A.

25.04.2025

FINANCIAL RESULTS OF YEAR 2024

Increase in Turnover to €370.4 million and Sales Volumes of 120.7 thousand tons

Strong Operating Profitability and Sustainable Low Net Debt

Proposal of Annual Dividend of ~€0.23 per Share

ATHEX: PLAT

Reuters: THRr.AT

Bloomberg: PLAT GA

|

Full Year Highlights

|

THRACE GROUP presents the financial results for the fiscal year 2024.

Annual Financial Results

In 2024, the Group’s turnover amounted to €370.4 million, compared to €345.4 million in 2023, representing a 7.2% increase. This significant growth was primarily driven by higher sales volumes, which rose to 120.7 thousand tons in 2024, from 109.7 thousand tons in 2023 — an increase of 10%.

Boosting sales volumes was a key strategic objective for 2024, and its successful achievement highlights the Group’s ability to strengthen its market share in the regions where it operates, despite the low growth rates of the broader economies.

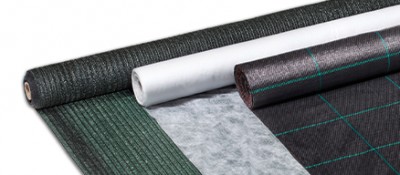

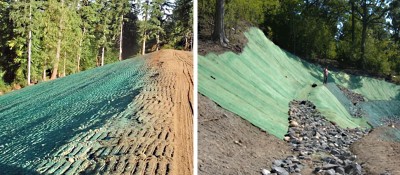

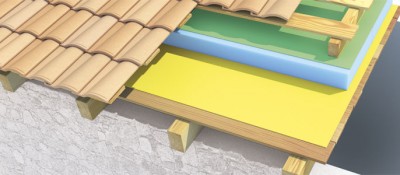

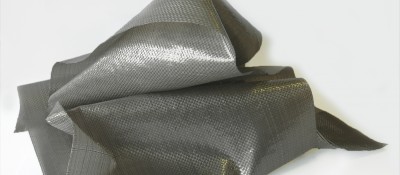

At the same time, this notable increase in sales volume reflects the continued improvement of the Group’s product portfolio. Supported by recent investments, the enhanced product portfolio has enabled access to new markets, geographic regions, and product categories, while also fostering a higher quality and more sustainable production process.

The Group’s operating profitability (EBITDA) for 2024 reached €41.4 million, while adjusted EBITDA stood at €42.3 million, compared to €44 million in 2023 — reflecting a slight decrease of approximately 4%.

This decline was primarily driven by the gap between raw material costs and average selling prices, coupled with an overall increase in the cost base across the industry — including inflationary pressures, higher personnel expenses, and elevated energy costs — trends that were broadly observed across the European Union. These factors significantly impacted the Group’s Cost of Goods Sold (COGS) and, consequently, its operating profitability. Nevertheless, the impact on profitability was marginal.

Throughout 2024 and into the early months of 2025, the sector continues to face elevated costs. As a result, several businesses and production units across Europe are suspending operations, contributing to a broader market re-balancing. In this evolving environment, Thrace Group is adapting effectively and consistently strengthening its market position.

The Group’s net debt stands at €34.4 million, reflecting a strong financial position. This low level of net debt underscores the quality of the Group’s customer portfolio and its ability to carry out investments while preserving robust liquidity. Furthermore, it enables the continued implementation of the Group’s dividend policy, supporting the distribution of increased dividends to shareholders.

More specifically, the following table depicts the key financial figures from continuing operations of the Group during the fiscal year 2024 compared to 2023:

|

CONSOLIDATED FINANCIAL RESULTS (in € thous.) |

31/12/2024 |

31/12/2023 |

Change (%) |

|

Turnover |

370,368 |

345,373 |

+7.2% |

|

Volumes Sold |

120,696 |

109,757 |

+10.0% |

|

Gross Profit |

77,140 |

77,069 |

+0.1% |

|

ΕΒΙΤ |

15,658 |

20,663 |

-24.2% |

|

EBITDA |

41,361 |

44,017 |

-6.0% |

|

EBITDA Adjusted* |

42,256 |

44,017 |

-4.0% |

|

EBT |

13,735 |

21,336 |

-35.6% |

|

Earnings after Taxes |

11,004 |

18,326 |

-40.0% |

|

Earnings after Taxes and Non-Controlling Interests |

10,363 |

17,767 |

-41.7% |

|

Basic Earnings per Share (in €) |

0.2415 |

0.4134 |

-41.6% |

*The Adjusted EBITDA does not include non-recurring expenses amounting to €895, related to the discontinuation of artificial grass production, an activity that the Group's Management decided to discontinue.

Prospects of the Group

Regarding the Group’s annual profitability for 2025, the uncertainty arising from the recent changes in market conditions—particularly following the imposition of new tariffs by the United States—makes it particularly challenging to provide a reliable estimate of the Group’s annual operating profitability (EBITDA). However, based on the Group’s annual forecasts and assuming that current conditions remain stable, it is estimated that EBITDA for the full year 2025 will exceed 2024 levels.

For the first quarter of 2025, initial projections indicate a decline in EBITDA of approximately 20%–25% compared to the first quarter of 2024. This development was anticipated, given the significant increase in raw materials and, most notably, energy costs, which have risen sharply compared to the same period in the previous year. (Energy costs in Q1 2025 increased by approximately €2.5 million year-over-year)

Commenting on the financial results, Mr. Dimitris Malamos, CEO of Thrace Group, stated:

“In 2024, Thrace Group delivered another year of strong performance, navigating heightened market uncertainty with confidence and resilience. The Group achieved a 10% increase in sales volumes and recorded a significant rise in Turnover. At the same time, we maintained a solid EBITDA profitability level and further strengthened our leading position across core business sectors, expanding into new markets and product categories.

As we enter the new financial year, Thrace Group is fully prepared not only to confront ongoing challenges but also to seize emerging opportunities. Following a series of key investments, the Group is focused on maximizing its positive impact and further enhancing the value it delivers to its people, partners, shareholders, and society at large.”

The Management of THRACE GROUP will host a Conference Call for the annual presentation to the Analysts, to present the financial year 2024 Financial Results. The Conference Call will take place on Wednesday, April 30, 2025. The details for the conference call will be announced in due time via a new press release by the Company on its website.

For further clarifications or information regarding the present release you may refer to the Department of Investor Relations and Corporate Announcements, tel.: + 30 210-9875081.